If you are looking to fool your friends and family by depositing a large sum of money into their bank accounts without actually depositing anything, then you should read this post. Flash money is a process of adding money to your bank account balance without actually depositing cash or checks. This post on how to flash money into a bank account will show you how to make your bank account have more money than it actually does. Just to be clear, this is completely different from creating a fake bank account balance. In creating a fake bank account balance, you are employing tactics of fake designs for your tricks.

To flash money into a bank account, you’ll need to use a variety of methods. These methods can include using flash funds apps, transferring money from a credit card to your bank account, or even using a third-party service to transfer money to your bank account. However, before you start flashing money, it’s important to understand the requirements and potential risks involved.

In this article, we’ll explore the ins and outs of flashing money into a bank acount, including the requirements, methods, and potential risks involved. By the end of this article, you’ll have a clear understanding of how to flash money into your bank account and whether it’s the right choice for you.

Key Takeaways

Flashing money is a process of adding money to your bank account balance without actually depositing cash or checks.

To flash money into a bank account, you’ll need to use a variety of methods, including flash funds apps and transferring money from a credit card to your bank account.

Before you start flashing money, it’s important to understand the requirements and potential risks involved.

What is Flashing Money?

Flashing money describes the act of sending a small amount of money to a bank account in order to verify that the account is active and can receive funds. You do this by sending larger amount of money to the same account. Another name for Flashing money is “testing” or “pinging” an account.

How Flash Funds Work

Flash funds are a type of financial transaction that involves sending money quickly and securely from one account to another. You can use flash funds for many purposes, including paying bills, making purchases, and sending money to friends and family.

To use flash funds, you will need to have access to a flash fund service or app. These services typically require you to provide your bank account information and may charge a fee for each transaction. Once you have set up your account, you can send money to other accounts by entering the recipient’s account details and the amount you want to send.

Requirements to Flash Money into a Bank Account

If you want to flash money into a bank account, there are a few requirements you need to meet to start. In this section, we’ll cover the necessary identification, choosing a bank, setting up an online banking account, and understanding VPN and Wi-Fi requirements.

Necessary Identification

Before you can flash money into a bank account, you’ll need to input certain documents like the bank name, account number, address of recipients, date of sending, and other information, just like you will do when looking to send someone money.

Select the right bank

Some banks don’t accept flash funds from non-financial institutions. So it is important to verify that a bank allows flash funds, before trying to send flash funds to the bank account. Some popular banks in the United States like Ally, Chase, and Wells Fargo accepts flash fund, including many credit unions or local banks.

VPNs and Wi-Fi

When flashing money into a bank account, it’s important to use a secure internet connection. This means using a VPN and connecting to a secure Wi-Fi network. A VPN encrypts your internet traffic and hides your IP address, making it more difficult for hackers to intercept your data. Make sure you use a reputable VPN service and connect to a secure Wi-Fi network.

In summary, to flash money into a bank account, you’ll need to provide identification, choose a reputable bank, set up an online banking account, and use a secure internet connection. By meeting these requirements, you can safely and securely transfer funds to your desired recipient’s bank account.

How to Flash Money into a Bank Account

If you are not a financial institution and want to flash money into a bank account, you have just one option.

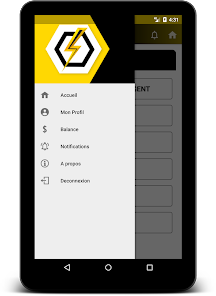

Use the Flash Fund App

Flash funds apps are software applications that allow you to transfer money from one bank account to another almost instantly. This is a secret tool that is currently hidden from the public because of its potency.

These apps are commonly used by hackers to conduct fraudulent activities such as sending fake bank alerts, but they can also be used for legitimate purposes such as sending fake money to friends and family.

This app allows you to transfer money to any bank account. All you have to do is input all the requirements we have mentioned above, and the money will reflect.

Bear in mind that the money isn’t real but will only increase the account balance of the recipient for a while, and cannot be withdrawn. Fraudsters use this tool as a mean for doing fake transfer when buying goods from someone.

How to Use Flash Funds Apps

Using flash funds apps is relatively easy. First, you need to download and install the app on your mobile device. Once installed, you will need to create an account and provide your personal and financial information.

To transfer money using a flash funds app, you will need to provide the recipient’s bank details, including the account number and routing number. Once you have provided this information, you can initiate the transfer and the money will be transferred almost instantly.

It is important to note that while flash funds apps can be useful for legitimate purposes, they can also be used for fraudulent activities. It is important to only use reputable flash funds apps and to ensure that you are not engaging in any illegal activities.

Overall, flash funds apps are a convenient way to transfer money quickly and easily. However, it is important to use these apps responsibly and to ensure that you are not engaging in any illegal activities.

Potential Risks and Consequences of Flashing Money

Flashing money into a bank account may seem like an easy way to get quick cash, but it can come with significant risks and consequences. It is important to understand these risks before attempting to flash money into a bank account.

Legal Implications

Flashing money into a bank account is illegal and can lead to serious legal consequences. If caught, you could face charges of fraud, money laundering, or even theft. These charges can result in hefty fines and even jail time. It is crucial to understand that the risks far outweigh the potential rewards of flashing money into a bank account.

Financial Risks

There are also financial risks associated with flashing money into a bank account. One potential risk is that the bank may freeze your account. This can happen if the bank suspects fraudulent activity or if you violate the bank’s terms and conditions. Additionally, if you use a fake bank alert to deceive the recipient into thinking that the money has been deposited, you could be liable for any financial losses they incur.

Another risk is that you may be using a hacking tool to flash money into the bank account. This can open up your computer or phone to malware and other security threats. Hackers can use these tools to steal your personal information or even take control of your device.

Finally, flashing money into a bank account can also affect your available balance and inventory. If you flash more money than you have in your account, you could end up with a negative balance. This can lead to overdraft fees and other financial consequences.

[joli-faq-seo id=’10758′]Conclusion

In conclusion, flashing money into a bank account is not worth the risks and consequences. It is important to understand the legal and financial risks associated with this activity before attempting it. Instead, consider legal and ethical ways to earn money and avoid any potential legal or financial issues.

Chat

Please provide the flash app

Give me an email to contact you