Your spouse and you might have invested in cryptocurrency a while ago during your marriage. But now that you’re getting a divorce, do you think anyone will talk about the cryptocurrency that you both purchased? And if you do own cryptocurrency, will be an income or an asset?

Just in case if you or your partner own cryptocurrency then make sure you tell this to your divorce lawyer because it may be an asset that needs to be valued and divided. It will require the need to be valued because cryptocurrency wavers like wildfire. And since cryptocurrency is tricky to track it can complicate divorce for both spouses.

Owning cryptocurrency isn’t a criminal activity, but it can be. A lot of people do use cryptocurrency to make purchases online that to make sure their transactions are safe. And cryptocurrency can also be used as an investment.

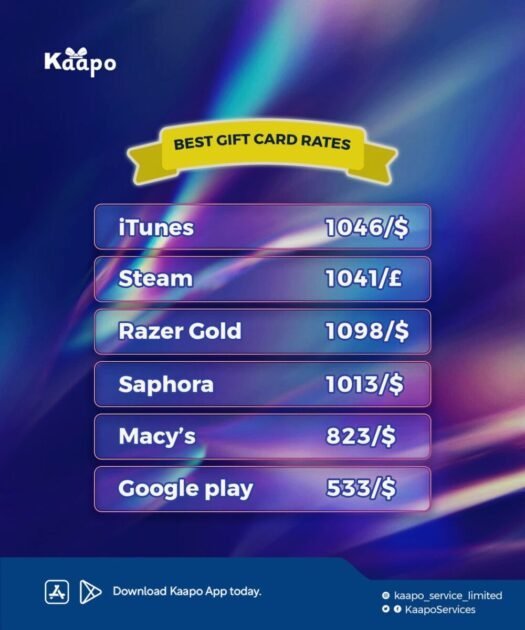

Cryptocurrency can be converted into real money. It will be helpful to know about programs that tell you about the conversion rate of cryptocurrency.

5 Tips to Dealing with Cryptocurrency in your Divorce:

Refrain From Deleting Any Information About The Cryptocurrency

If you have any living proof about owning cryptocurrency we would suggest you not delete it nor close any cryptocurrency accounts. All evidence in a divorce must be saved. If you delete the data, there might be consequences for those. One of the consequences could be that the judge could assume the evidence was deleted for negative purposes and you can lose the argument.

Searching For Cryptocurrency

First of all, you all need to know if you actually do have any cryptocurrency because that is crucial information to you and your lawyer. Have you discussed crypto with your partner? Is there any information on your bank statement about the trading? Does it exist? And if any of these pieces of information turn out to be true, you must report them to your lawyer. The rest will be up to your lawyer to search for any more information about the cryptocurrency.

Gathering Evidence About Cryptocurrency

Garnering any evidence about owning cryptocurrency can be tough. Often the entire point of owning cryptocurrency is that all the transactions are private or secure. First of all, we need to find out whether the owner has a wallet that is available on digital platforms or a physical device.

It’s pretty simple after that. The owner of the cryptocurrency can download the rest of the transaction history information from their wallet or exchange program. The info has bank statements. This will also help you find any other assets.

Think About How It Will Have An Impact On Your Tax Filing

Any person may or may not receive tax documents about their cryptocurrency accounts. Whether or not someone bears tax documents depends on if the individual’s account hits certain parameters stipulated by the exchange being used. If they meet the variables, then tax documents will be emanated.

If you have cryptocurrency which is having an impact on your tax filing, you must immediately discuss this with your divorce lawyer. Failing to do so will again give rise to complications in the divorce.

Shifting Cryptocurrency

The person who receives the currency should make sure they know about it before accepting the said currency if there is an occurrence of virtual currency transferring during the divorce. This would help in not raising any confusion or rebuttal later when they are asked about the currency exchange between the two parties.

Owning bitcoins is like owning thequantumai, it is a massive opportunity to having the most amount profits in your later lives. So purchase them and make sure if your partner purchases them along with you, the both of you know of the occurrence. Because if there is a divorce later, both of you will need to tell your lawyer to avoid any controversy in the court later.