If you own an online business, you’d know how important it is to have a reliable and well-secured payment gateway that can help your customer’s process transactions fast and swift. But the biggest challenge to making more sales is the need for payment gateways requesting for OTPs. Several customers are looking for the best payment gateways without OTP and looking to process a swift online transaction without OTP. This blog post will help point you towards the right direction.

Many customers might have lost their means of online payment verification, making it difficult for them to complete transactions. In this case, they are looking for several 2d payment gateways without OTP to complete their online transaction.

Several payment gateways are available that don’t require OTPs, meaning checkouts are faster, efficient, and more convenient for customers online. These gateways have evolved to use other methods to detect fraud without the need for OTPs.

Stripe is currently one of the best payment gateways without OTP. This payment gateway verifies a transaction by looking at your purchase history and sending a link to any email you input during checkout.

There are other payment gateways without OTP, and we will cover all of them in a bit.

But remember that this post is targeted at customers who are looking to make legitimate purchases, and not for fraudulent use. Using someone else’s credit card for online purchase is a crime and punishable by law.

Best Payment Gateways Without OTP

Some of these payment gateways without OTP are popular, but many customers don’t know about it yet. It will be surprising to see that you can make online transactions without OTP, using some of these popular payment gateways. Let me show you.

PayPal Express Checkout

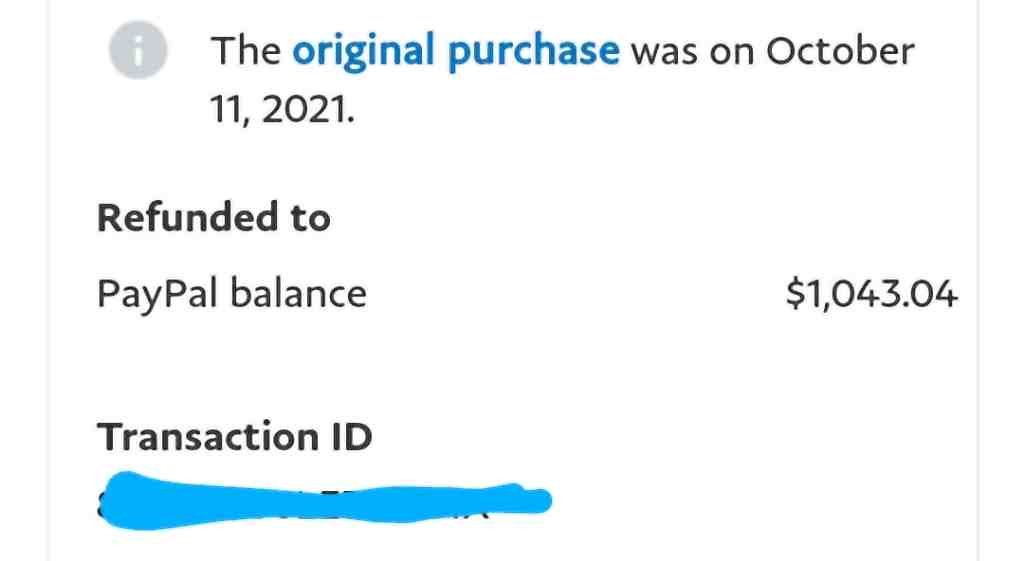

PayPal Express Checkout is a payment gateway that allows customers to pay without entering their credit card details or OTP. Instead, customers can use their PayPal account to complete the transaction. PayPal is a widely recognized and trusted payment option, and it’s available in over 200 countries and regions.

Online sellers can easily integrate PayPal into their website or mobile app, and customers can complete transactions quickly and securely.

Stripe Payment Gateway

Stripe is a popular payment gateway that enables businesses to accept payments without OTP. This technology offers a range of features, including support for over 135 currencies and the ability to accept payments from all major credit and debit cards.

For Stripe, it also offers advanced fraud protection and customizable checkout options. An online seller can use an email link or code entered by the user to complete an online transaction without OTP sent by the debit card issuer.

With Stripe, sellers can easily integrate the payment gateway into their website or mobile app and start accepting payments in minutes.

Amazon Pay

Amazon Pay is a payment gateway that allows customers to pay without OTP. This payment gateway enables customers to use their Amazon account to complete transactions, making it a convenient and secure payment option.

If you own an online store, you can easily integrate Amazon Pay into their website or mobile app, and customers can complete transactions quickly and securely.

Braintree Payment Gateway

Braintree is a payment gateway that allows merchants to accept payments without OTP. It offers a range of features, including support for all major credit and debit cards and the ability to accept payments in over 130 currencies.

This payment method uses some advanced fraud detection technology without the need for sending OTPs to complete online transactions. Online sellers can integrate Braintree as a 2d payment gateway without OTP and start accepting payments immediately.

2Checkout Payment Gateway

2Checkout is a payment gateway that enables businesses to accept payments without OTP. This payment gateway without OTP offers a range of features, including support for over 45 payment methods and the ability to accept payments in over 200 countries and regions.

It uses some advanced fraud protection to complete online transactions and has a customizable checkout option. If you want to make an online transaction without OTP, look for stores using 2Checkout as their payment gateway.

Authorize.net Payment Gateway

Authorize.net uses other fraud detection techniques instead of OTPs to secure online purchases made via its payment gateway. It allows merchants to accept payments without OTP. Authorize.net offers a range of features, including support for all major credit and debit cards and the ability to accept payments in over 190 countries and regions.

If you see a store that uses Authorize.net as its payment gateway, then you can make an online transaction on that store without OTP sent to your phone.

Other Payment Gateways without OTP

Some of the top payment gateways without OTPs include Razorpay, PayU, and Instamojo.

Razorpay is a popular choice for businesses in India, offering a range of payment options and integrations with popular e-commerce platforms.

PayU is another popular gateway that supports multiple currencies and offers fraud detection tools to help protect your business.

Instamojo is a newer player in the market but has gained popularity for its easy-to-use interface and low transaction fees.

Pros of Using Payment Gateways without OTP

Faster Checkout Process

One of the main benefits of using a payment gateway without OTP is that it speeds up the checkout process. Without the need for an OTP, customers can complete their transactions more quickly, which can lead to a better overall shopping experience.

This is especially important for customers who are shopping on mobile devices, where entering an OTP can be more difficult and time-consuming.

Improved User Experience

Another benefit of using a payment gateway without OTP is that it can improve the overall user experience.

Customers are more likely to complete their transactions if the process is quick and easy, and not having to enter an OTP can make the process much smoother. This can lead to increased customer satisfaction and loyalty.

Increased Conversion Rates

Businesses can increase their conversion rates by using a payment gateway without OTP. When customers are able to complete their transactions quickly and easily, they are more likely to follow through with their purchases. This can lead to increased sales and revenue for businesses.

Overall, using a payment gateway without OTP can provide a number of benefits for both businesses and customers. Businesses can increase their conversion rates and build customer loyalty by streamlining the checkout process and improving the user experience.

Cons of Using Payment Gateways without OTP

Security Risks

One of the biggest drawbacks of using payment gateways without OTP is the increased security risks. OTP or One-Time Password, is a security feature that adds an extra layer of protection to your online transactions. Not requiring OTP makes payment gateways vulnerable to hacking and phishing attacks, leading to unauthorized access to sensitive information such as credit card details, bank account information, and personal data.

Without OTP, anyone with access to your credit card or bank account details can make payments on your behalf without your knowledge or consent. This can result in financial losses, identity theft, and other cybercrimes, which can seriously affect you and your business.

Fraudulent Transactions

Another major drawback of using payment gateways without OTP is the increased risk of fraudulent transactions. OTP is an effective way to prevent fraudulent transactions by verifying the user’s identity. Without OTP, fraudsters can easily make transactions using stolen credit card details or other sensitive information.

Payment gateways without OTP are also more susceptible to chargebacks, which can lead to financial losses for merchants. Chargebacks occur when a customer disputes a transaction and the payment gateway reverses the transaction, leaving the merchant without the payment and the product or service they provided.

Overall, using payment gateways without OTP can be risky and lead to financial losses and other security issues. It is important to weigh the benefits and drawbacks of using payment gateways without OTP and take appropriate measures to protect your online transactions and sensitive information.

FAQs on Payments without OTP

Can online payment be made without OTP?

Online payment can be made without OTP, depending on your payment gateway. Some payment gateways require OTP, while some don’t. A popular payment gateway that doesn’t send OTPs is Stripe.

Does Stripe use OTP?

Stripe doesn’t send automatic OTPs when using their payment gateway to make an online transaction. Stripe allows you to provide an email address, where they send you a link to complete the transaction.

Can I use Stripe without verification?

You can use Stripe without verification; you only need to provide your card details and email address. A code will be sent to the email address you provided to complete purchases.

Summary

So far, we have seen that Stripe is the best payment gateway without OTP because it uses machine learning to detect when card testing is required.

Allowing customers to buy without OTP makes the buying process faster, easier, and efficient, especially for customers who don’t have access to their phones. But it is important to note that payment gateways without OTP may be less secure than those with OTP, as they don’t provide an additional layer of authentication. Merchants should take extra precautions to protect their customers’ payment information, such as using SSL encryption, PCI compliance, and fraud detection tools.

In addition, merchants should be aware of the potential risks of chargebacks and fraud and have a clear refund and dispute resolution policy in place. They should also choose a payment gateway that is compatible with their e-commerce platform and offers competitive pricing and customer support. Overall, payment gateways without OTP can be a good option for merchants who want to offer a seamless and streamlined checkout experience to their customers, but they should also be aware of the potential risks and take steps to mitigate them.